Leveraging San Diego Small Business Tax Experts For Success

With inventory, the ordinary expense increased to $323. Independent workers paid a standard of $192 to have their Schedule C type prepared.

The adhering to red flags might imply a person is unskilled at ideal or a criminal at worst. Promises of a remarkable return. If it seems also excellent to be real, it probably is. Bronnenkant advises caution with anyone making "magnificent assurances" of a large tax obligation return, especially prior to they have had a possibility to take a look at your particular financial details.

Refusal to authorize a return. By legislation, a preparer should authorize the kind of any type of return they finish. "Be mindful not to authorize returns that a preparer isn't going to authorize," Timber says. Do not include your signature until you see your preparer add their name. A short-lived office or missing web site.

Tax Professionals: Key Players In San Diego's Economic Growth

Should you be investigated or have a question about your return later on, you want to guarantee the preparer will be simple to locate. Legit tax obligation preparers will certainly charge either a hourly or flat fee for their work.

Should you be investigated or have a question about your return later on, you want to guarantee the preparer will be simple to locate. Legit tax obligation preparers will certainly charge either a hourly or flat fee for their work.If something concerning a tax obligation preparer does not really feel right, keep looking. If a preparer doesn't seem to recognize your inquiries or tax situation, that can be a sure indicator they're not the best person to finish your return.

Page Last Assessed or Updated: 23-Mar-2023.

San Diego Tax Management: Strategies For Streamlining Your Finances

Maybe you've collaborated with a tax preparer before, but did you ever inquire about their qualifications? Lots of people do not, despite the fact that tax obligation advisors have access to details about your most personal information, including your checking account, your marital relationship, your kids as well as your Social Safety number. Aside from vetting a tax preparer, there are some other factors to consider to remember when seeking tax obligation aid.

The IRS needs any individual who prepares or helps in preparing government tax obligation returns for settlement to have a preparer tax obligation recognition number, or PTIN. Keep in mind the expression "for compensation" volunteer tax obligation preparers don't need PTINs. Ensure your revenue tax preparer places their PTIN number on your return; the internal revenue service calls for that, also.

The amount of recurring research study for each and every classification will certainly differ, however these professionals are normally held to a greater standard of education as well as experience. You can likewise take into consideration dealing with a tax obligation pro who has completed the internal revenue service' Annual Declaring Season program. The Accredited Company Accountant/Advisor as well as Accredited Tax obligation Preparer are instances of programs that assist preparers fulfill the Annual Filing Period Program demand.

The Benefits Of Hiring Tax Consultants In San Diego

It consists of preparers with PTINs and also IRS-recognized professional qualifications. Volunteer preparers as well as preparers with just PTINs will not remain in the database. Membership in a professional company such as the National Organization of Tax Obligation Professionals, the National Organization of Enrolled Representatives, the American Institute of Qualified Public Accountants, or the American Academy of Attorney CPAs is constantly a good idea to have in a tax expert, as most have codes of principles, specialist conduct demands and different qualification programs (CPA San Diego).

Their company might be able to quickly attach you with a tax obligation expert. Tax Planning Made Easy, There's still time to get your tax obligations done right with Harness Tax. Exactly how much do tax obligation preparers bill? In 2023, the average cost for preparing a non-itemized Kind 1040 is around $210, according to a 2022 Drake Software program study of over 3,600 tax obligation preparers in the USA.

Usually, tax preparers either charge a minimum fee, plus cost based on the complexity of your return, or they charge an established charge for each form and also schedule required in your return. If you stumble upon a tax preparer whose cost is based on the size of your reimbursement or who claims they can obtain you a larger reimbursement than the following person, that's a warning.

San Diego Small Business Tax Experts: Boost Your Business Growth

If your tax preparer does not offer e-file, it might be an indication the person isn't doing as much tax obligation preparation as you believed. The law requires paid preparers to sign their customers' returns and supply their PTINs - San Diego tax advisors. Never ever sign an empty income tax return the preparer could put anything on the return, including sites their very own savings account number so they can steal your reimbursement.

Preparers who simply have PTINs can't even if they prepared your return. Also after the declaring period is over as well as your tax obligation return is history, the best tax preparers will certainly take your telephone call, respond to your email, or invite you for a see.

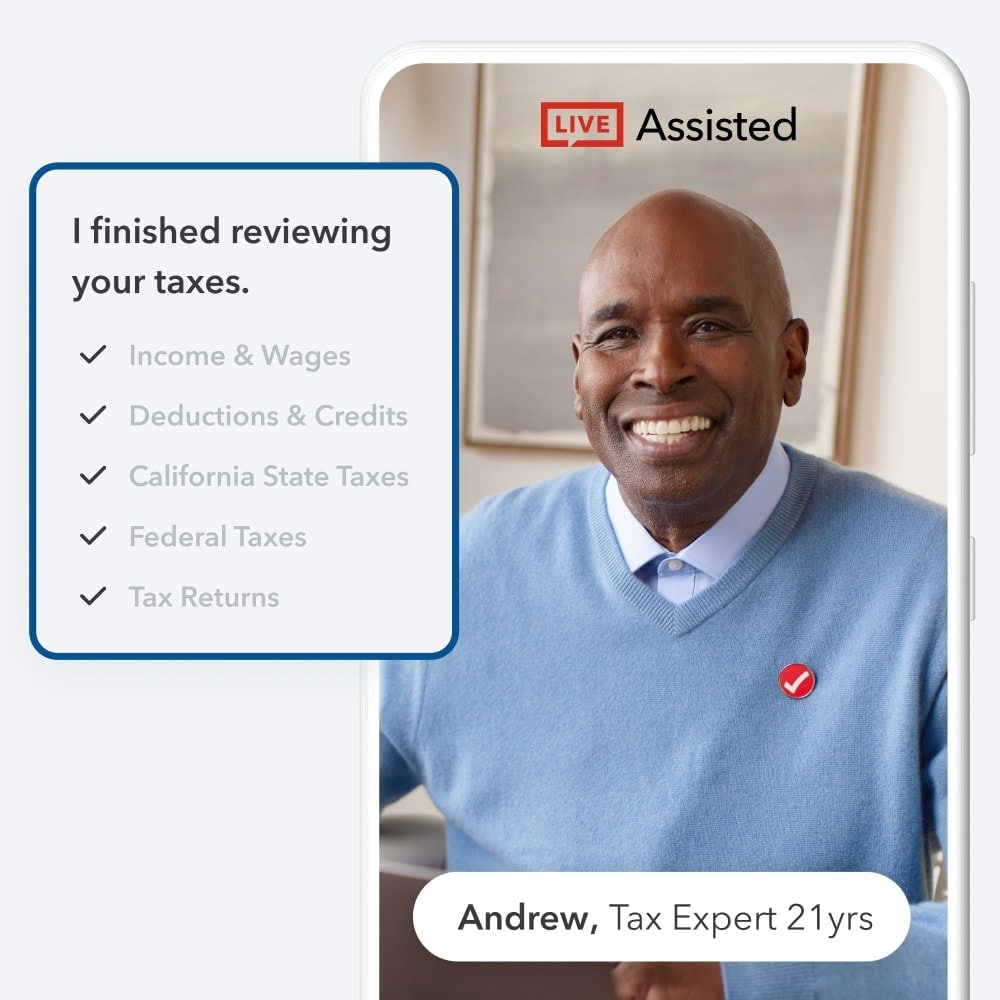

Numerous on-line tax preparers currently provide live help, so if you do have an inquiry while you're filing, you can obtain assist in actual time. Regularly asked concerns, Is it worth mosting likely to a tax preparer? If you have a rather straightforward income tax return, you might not require anything greater than a cost-free declaring solution.

San Diego Tax Management: Strategies For Streamlining Your Finances

Abbo Tax CPA

Address: 3131 Camino Del Rio N Ste 370, San Diego, CA 92108, United StatesPhone: +16192698190

Click here to learn more